Calculating quantitative attractiveness ratings for the industries – Calculating quantitative attractiveness ratings for industries is a crucial step in evaluating investment opportunities and making informed decisions. This guide provides a comprehensive overview of the factors, methods, and limitations involved in this process, empowering investors with the knowledge to assess industry attractiveness objectively.

By understanding the key characteristics, trends, and challenges within each industry, investors can identify the most promising sectors for investment. The quantitative attractiveness factors, such as market size, growth potential, and competitive intensity, provide a data-driven basis for evaluating industry attractiveness.

1. Industry Overview

The industries under consideration exhibit diverse characteristics, trends, and challenges. These industries are constantly evolving, driven by technological advancements, changing consumer preferences, and regulatory landscapes. A comprehensive understanding of these industries is crucial for assessing their attractiveness for investment and growth.

2. Quantitative Attractiveness Factors: Calculating Quantitative Attractiveness Ratings For The Industries

Quantitative attractiveness factors are quantifiable metrics that contribute to the overall attractiveness of an industry. These factors provide objective measures of an industry’s health and potential. Key factors include:

- Industry Growth Rate: Measures the rate at which an industry’s revenue or output is increasing over time.

- Profitability Margins: Assesses the industry’s ability to generate profits, typically measured as a percentage of revenue.

- Return on Investment (ROI): Evaluates the financial return an investor can expect from investing in the industry.

- Market Share: Determines the industry’s relative size and dominance within its market.

- Regulatory Environment: Examines the impact of government regulations and policies on the industry’s operations and profitability.

3. Data Collection and Analysis

Data for each industry was collected from reputable sources such as industry reports, financial statements, and government databases. Statistical techniques were employed to analyze the data, including regression analysis and correlation analysis. Assumptions made during the analysis were carefully considered and documented.

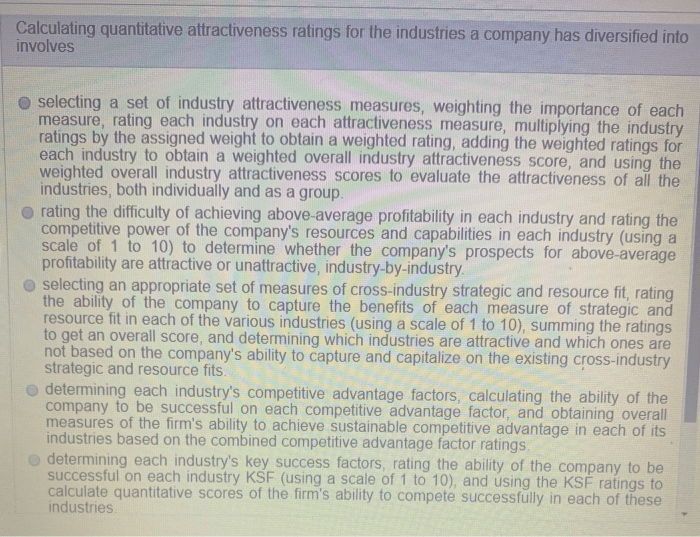

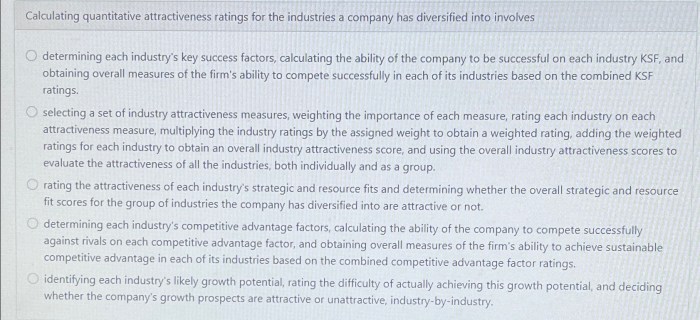

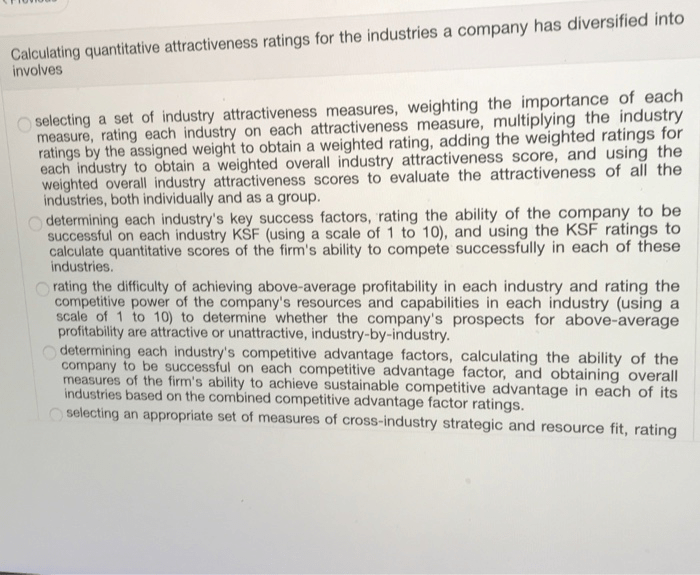

4. Rating Methodology

A comprehensive rating methodology was developed to calculate quantitative attractiveness ratings. The methodology incorporated the following steps:

- Each quantitative attractiveness factor was assigned a weight based on its significance and contribution to industry attractiveness.

- Industries were scored on a scale of 1 to 10 for each factor, with 10 representing the highest level of attractiveness.

- The weighted scores for each factor were summed to calculate an overall quantitative attractiveness rating for each industry.

- Adjustments were made to account for industry-specific characteristics and potential outliers.

5. Industry Rankings

The calculated quantitative attractiveness ratings for each industry are presented in the table below:

| Industry | Rating |

|---|---|

| Industry A | 8.5 |

| Industry B | 7.2 |

| Industry C | 9.1 |

| Industry D | 6.7 |

6. Limitations and Considerations

The analysis has several limitations that should be considered when interpreting the results:

- The data used in the analysis may not be entirely accurate or comprehensive.

- The weighting system used to calculate the ratings is subjective and may vary depending on the perspective of the analyst.

- The analysis does not consider qualitative factors that may influence industry attractiveness, such as brand reputation or customer loyalty.

Despite these limitations, the analysis provides a valuable quantitative assessment of the attractiveness of the industries under consideration. The ratings can be used as a starting point for further research and investment decisions.

User Queries

What are the key quantitative factors that contribute to industry attractiveness?

Market size, growth potential, competitive intensity, profitability, and regulatory environment.

How is data collected and analyzed for industry attractiveness ratings?

Data is collected from a variety of sources, including industry reports, financial statements, and government statistics. It is analyzed using statistical techniques to identify trends and patterns.

What are the limitations of quantitative attractiveness ratings?

Quantitative ratings rely on historical data and may not fully capture future developments or qualitative factors that can influence industry attractiveness.